Overview

A Focus on Impact

Missio Invest takes an “impact first” approach to investing. While financial returns are important for the sustainability of the Fund, Missio Invest prioritizes the social impact on vulnerable communities. By rejecting the exclusive focus on financial returns, impact investors share the same goal as impact investees: the creation of decent work, reliable income and the care of our common home.

Investments of this sort are meant to have positive social repercussions on local communities, such as the creation of jobs, access to energy, training and increased agricultural productivity.

Investments that Maximize Growth

SMEs comprise upwards of 90% of economic activity in Sub-Saharan Africa. However, SME growth is often hindered due to lack of financing. An increase in agricultural productivity has nearly twice the impact on reducing extreme poverty as a comparable productivity increase in industry or services. Yet, only 1% of bank lending in Africa is to the agriculture sector.

Missio Invest meets this need by increasing lending to undercapitalized agribusiness—the so-called missing middle—which serve as a catalyst of formal employment growth and increased agricultural productivity for low-income populations.

The Impact

- Unlocking Potential

- Improved Food Security

- Better Environmental Stewardship

People served in 2024 by our investee-operated health, education, and other social institutions are

19.7 Million

Strengthened Social Entities

Church-affiliated healthcare centers, schools, and other facilities are vital to the communities they serve.

The Impact

- Institutional Strengthening

- Expansion of Church-affiliated Services

- Greater Transparency and Accountability

Changemaker Witness, Uganda

Father Herman Kituuma

Rector, St. Thomas Aquinas Seminary

4 schools, 3 secondary schools, each one with 500 students

Promoting Integral Ecology

The ultimate impact can be found within the interdependent network of Church and other entities working together to improve the well-being of the most vulnerable. Recognizing the interconnectedness of environmental, economic, political, social and cultural issues, Missio Invest adopts interventions that promote comprehensive solutions to what are both environmental and human crises.

Our investees implement environmentally sustainable practices on over

4,012 Acres

and planted 228,623 trees in 2024

Our Financial Impact

The Power of Investing in Church Enterprises

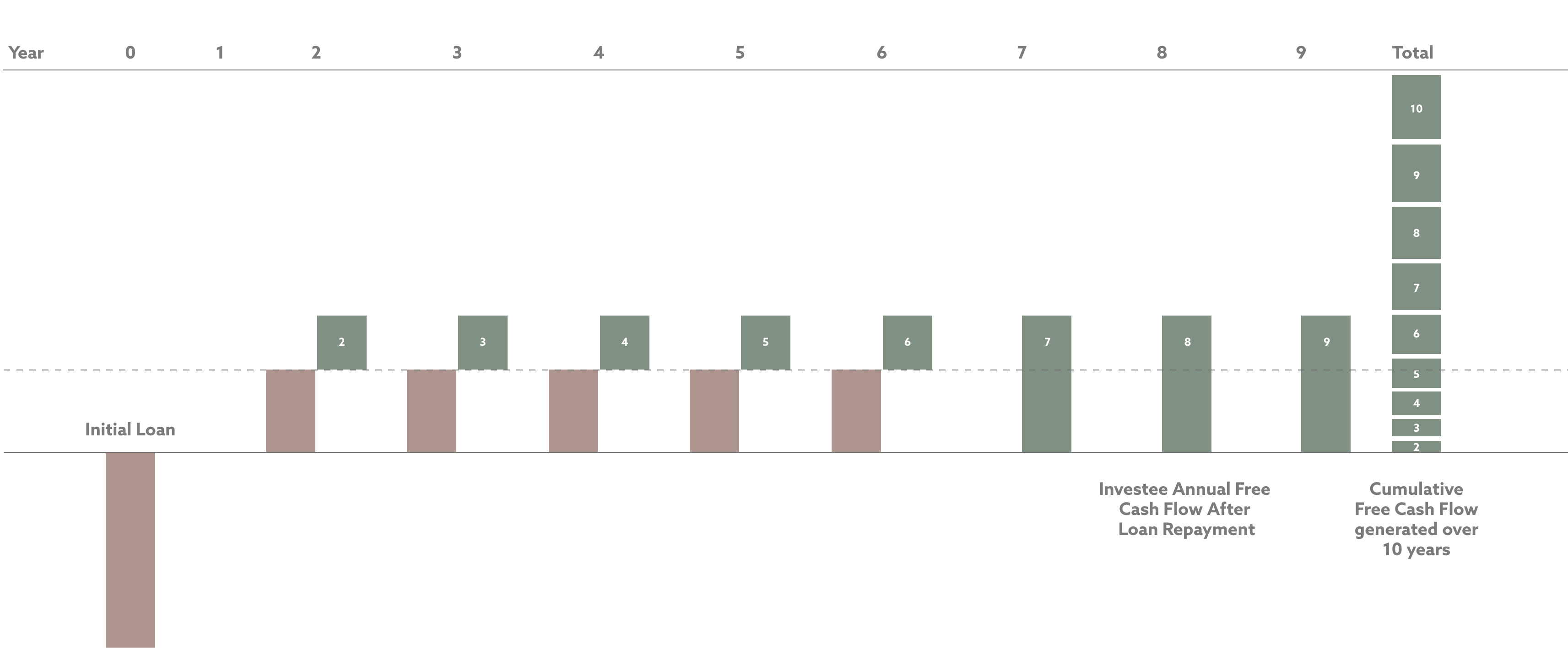

Missio Invest engages in a virtuous circle of issuing loans that are designed to make investees self-sufficient over the long-term.

Over a 10-year period, investees generate free cash flow equal to more than double the loan amount.

-

Loan and Loan Repayments

-

Free Cash Flow After Loan Payments

Free Cash Flow For Long-term Self-sufficiency

For the borrower to become financially self-sufficient, Missio Invest ensures that all investees can generate annual cash flow equal to 1.5 times the annual repayments. This ensures that borrowers can comfortably repay the loan without financial strain on the institution, even if a project doesn’t go according to plan. It also ensures that, after the loan is repaid, the borrower will have a steady stream of recurring income, which can be used to drive further business growth and expansion of social programs.

- Cumulative Investments Made:

- $119,031

- Free cash flow generated by investees over 10 years:

- $261,867

- Cumulative Number of Investees

- 7

- Number of Countries

- 1

- Country

- Kenya

$119,031

$261,867

- Cumulative Investments Made

- $3,722,710

- Free cash flow generated by investees over 10 years

- $8,189,962

- Cumulative Number of Investees

- 37

- Number of Countries

- 6

- Countries

- Kenya, Uganda, Malawi, Zambia,

Nigeria, Tanzania

$3,722,710

$8,189,962

- Cumulative Investments Made

- $40MM+

- Free cash flow generated by investees over 10 years

- $88MM+

- Cumulative Number of Investees

- 215

- Number of Countries

- 14-15+

- Countries

- Kenya, Uganda, Malawi, Zambia, Nigeria,

Tanzania, Ghana, Rwanda, Ethiopia, The Gambia,

Benin, Cote D’Ivoire, Cameroon, Senegal, Namibia

$40MM+

$88MM+

- Cumulative Investments Made

- $75MM

- Free cash flow generated by investees over 10 years

- $165MM

- Cumulative Number of Investees

- 425

- Number of Countries

- 16+

- Countries

- Kenya, Uganda, Malawi, Zambia, Nigeria,

Tanzania, Ghana, Rwanda, Ethiopia, The Gambia,

Benin, Cote D’Ivoire, Cameroon, Senegal,

Namibia, Cambodia, Sri Lanka

$75MM

$165MM

IMPACT BY THE NUMBERS

Measuring the Difference

Different types of projects operated by different religious entities will achieve different impact outcomes. While a Sisters’ Congregation and a Diocese might both operate agribusinesses, their social outcomes might differ if, for example, the Sisters run schools, and the Diocese is managing a hospital.

To view the impact of a given investment amount, scroll to the desired investment amount on the left, and then scroll through the corresponding impact outcomes on the right. Each investment amount has its own array of illustrative impact outcomes.